Introduction: In recent years, sustainable investing has gained significant traction, driven by the growing awareness of environmental, social, and governance (ESG) factors. Investors are increasingly recognizing the power of aligning their financial goals with their values, making a positive impact on the world while also growing their wealth. In this blog post, we will explore the concept of sustainable investing and how it allows individuals to invest in companies that prioritize sustainability and social responsibility. We will discuss the benefits of sustainable investing and provide practical tips to help you get started on your sustainable investment journey.

- Understanding Sustainable Investing: To begin, we’ll define sustainable investing and its core principles. We’ll explain how it goes beyond traditional financial considerations by incorporating ESG factors into investment decision-making. We’ll discuss the three pillars of sustainable investing: environmental, social, and governance, and their impact on long-term investment performance.

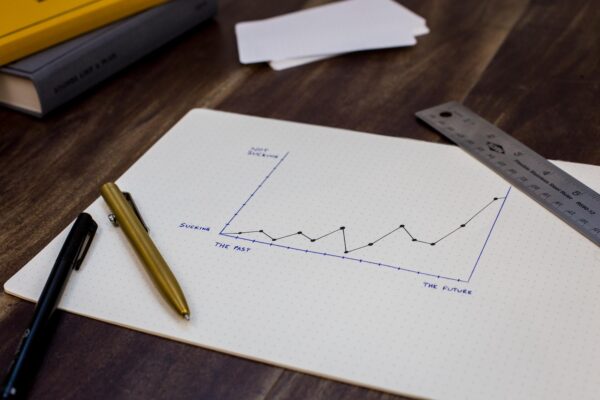

- The Rise of Sustainable Investing: Sustainable investing has witnessed exponential growth in recent years. We’ll explore the factors contributing to its rise, including changing investor preferences, increasing regulatory focus, and the recognition of the materiality of ESG factors in financial performance. We’ll highlight the growing availability of sustainable investment products and the expanding range of investment opportunities across various asset classes.

- The Benefits of Sustainable Investing: Sustainable investing offers a range of benefits beyond financial returns. We’ll discuss how it allows investors to align their investments with their personal values, support companies that prioritize sustainability and social responsibility, and contribute to positive change. Additionally, we’ll explore studies that suggest sustainable investing may lead to long-term financial outperformance.

- Strategies for Sustainable Investing: We’ll provide an overview of different sustainable investing strategies and approaches. From negative screening and positive screening to thematic investing and impact investing, we’ll explain the various ways investors can incorporate sustainability into their investment portfolios. We’ll discuss the importance of setting investment objectives and selecting strategies that align with your values and risk tolerance.

- Evaluating ESG Factors: Assessing ESG factors is a fundamental part of sustainable investing. We’ll explore the criteria used to evaluate companies’ environmental, social, and governance practices. We’ll discuss the importance of robust data and research in making informed investment decisions, and we’ll highlight various tools and resources available for evaluating ESG performance.

- Engaging with Companies: Engagement and active ownership are essential elements of sustainable investing. We’ll discuss how investors can engage with companies to promote sustainable practices, influence corporate behavior, and drive positive change. We’ll also explore the role of shareholder advocacy and proxy voting in advancing sustainable investing objectives.

- Measuring Impact and Reporting: Measuring the impact of sustainable investments is crucial to ensure transparency and accountability. We’ll discuss frameworks and metrics used to assess impact, such as the United Nations Sustainable Development Goals (SDGs) and the Global Reporting Initiative (GRI). We’ll also explore the importance of company reporting on ESG performance and the increasing demand for standardized and comparable data.

- Integrating Sustainable Investing into Your Portfolio: We’ll provide practical tips for integrating sustainable investing into your investment portfolio. From starting with a small allocation to gradually increasing your exposure, we’ll guide you on building a well-diversified and sustainable investment portfolio. We’ll also discuss the importance of ongoing monitoring and evaluation of your investments to ensure they continue to align with your sustainability goals.

Conclusion: Sustainable investing presents a unique opportunity to make a positive impact on the world while growing your wealth. By aligning your investments with your values and incorporating ESG factors into your decision-making process, you can contribute to a more sustainable and responsible future.