Introduction:

Investing in the stock market can be both exciting and challenging. One of the key factors that investors constantly monitor is whether the market is in a bull or bear phase. A bull market represents a period of rising stock prices and optimism, while a bear market signifies a decline in prices and pessimism. Navigating these market conditions requires careful consideration and the implementation of effective strategies. In this blog, we will explore some essential strategies that investors can employ to navigate the bull or bear market successfully.

- Understand the Market Phases:

To navigate the bull or bear market effectively, it’s crucial to understand the characteristics of each phase. A bull market is typically driven by positive economic indicators, low unemployment rates, and strong corporate earnings. On the other hand, a bear market is often accompanied by economic downturns, rising unemployment, and declining corporate profits. By recognizing the signs and understanding the underlying factors, investors can make more informed decisions.

- Diversify Your Portfolio:

Diversification is a fundamental strategy that can help investors manage risk during both bull and bear markets. By allocating investments across different asset classes, sectors, and geographical regions, investors can reduce the impact of market volatility on their portfolio. Diversification allows for a balance between higher-risk, higher-reward investments and more stable, defensive assets.

- Focus on Quality Investments:

During a bull market, it’s common for investors to be lured by the hype and invest in speculative or overvalued assets. However, in order to navigate the market successfully, it’s important to focus on quality investments. Look for companies with solid fundamentals, strong balance sheets, and sustainable competitive advantages. Quality investments tend to weather market downturns more effectively and have the potential for long-term growth.

- Stay Informed and Analyze Data:

In both bull and bear markets, staying informed and conducting thorough research is essential. Keep track of economic indicators, company earnings reports, and market trends. By analyzing data and staying updated on relevant news, investors can make informed decisions based on facts rather than emotions. This will help mitigate the risks associated with market fluctuations.

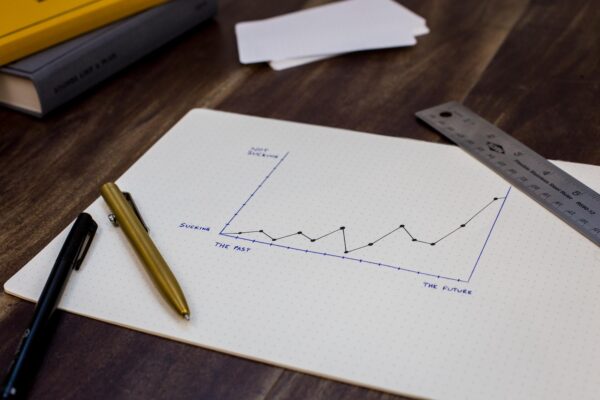

- Maintain a Long-Term Perspective:

Investing is a long-term endeavor, and it’s important to maintain a disciplined approach, regardless of market conditions. During a bull market, it’s tempting to chase quick gains and adopt a short-term mentality. However, successful investors understand the importance of patience and the compounding effect of long-term investing. Similarly, during a bear market, it’s crucial to avoid panic selling and stick to your investment strategy.

- Consider Dollar-Cost Averaging:

Dollar-cost averaging is a strategy that involves investing a fixed amount of money at regular intervals, regardless of market conditions. This approach allows investors to buy more shares when prices are low and fewer shares when prices are high. By following this strategy, investors can benefit from market volatility, potentially lowering the average cost per share over time.

- Be Prepared for Opportunities:

Both bull and bear markets present opportunities for investors. During a bull market, it’s important to be cautious and not get carried away by market exuberance. Similarly, during a bear market, it’s crucial to keep an eye out for undervalued assets that may present attractive buying opportunities. Being prepared and having a plan in place will allow investors to capitalize on these opportunities when they arise.

Conclusion:

Navigating the bull or bear market requires a combination of knowledge, discipline, and a long-term perspective. By understanding the market phases, diversifying your portfolio, focusing on quality investments, staying informed, maintaining a long-term perspective, considering dollar-cost averaging, and being prepared for opportunities, investors can navigate the market successfully. Remember, investing is a journey