Welcome to the world of investing! Whether you’re a young professional looking to secure your financial future or a seasoned individual seeking to grow your wealth, investing is a crucial step towards achieving your goals. However, navigating this vast landscape can be daunting for beginners. Fear not! In this beginner’s guide, we’ll unlock the secrets of building wealth through investing and provide you with essential tips and strategies to get started on your journey.

Investing 101: Unlocking the Secrets to Building Wealth

Investing is like planting seeds that have the potential to grow into fruitful trees. It is a long-term commitment that requires patience, knowledge, and a well-thought-out plan. The primary goal of investing is to make your money work for you, generating passive income and allowing you to build wealth over time. But where do you even begin?

The first step is to educate yourself. Take some time to understand the different investment options available, such as stocks, bonds, mutual funds, or real estate. Learn about their risks, potential returns, and how they fit into your overall financial goals. Reading books, attending seminars, or consulting with financial advisors can be invaluable resources to gain this knowledge.

Once you have a solid understanding of the investment landscape, it’s time to set your goals. Determine what you want to achieve through investing – whether it’s saving for retirement, buying a house, or funding your child’s education. Setting clear goals will help you focus your efforts and make informed decisions about your investments.

Planting the Seeds of Success: A Beginner’s Guide to Investing

Before diving into the market, it’s essential to build a strong foundation. Start by creating an emergency fund that covers at least three to six months of living expenses. This fund will act as a safety net and protect your investments from unexpected financial setbacks.

Now, let’s talk about risk and diversification. Investing always involves a level of risk, but you can mitigate it by diversifying your portfolio. Spread your investments across different asset classes and industries to reduce the impact of a single investment’s performance on your overall wealth. This way, if one investment underperforms, others may compensate and maintain your portfolio’s stability.

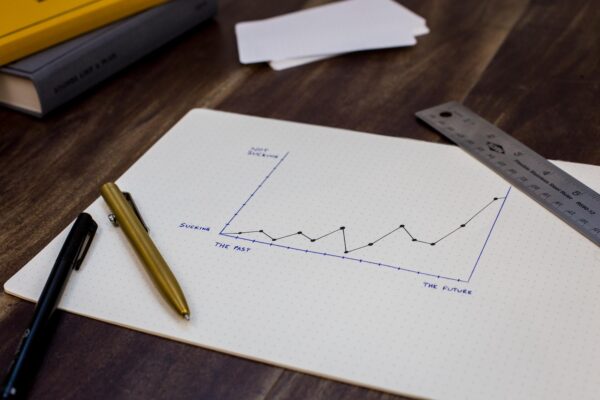

Another crucial aspect of investing is having a long-term perspective. The stock market, for example, experiences fluctuations in the short term, but historically, it has shown growth over extended periods. By staying invested for the long haul, you can weather the storms of volatility and benefit from the market’s overall upward trend.

Congratulations! You’ve taken the first steps towards building wealth through investing. Remember, investing is not a get-rich-quick scheme but a steady process that requires discipline, patience, and continuous learning. As you progress on your investment journey, regularly review your portfolio, adjust your allocations based on changing circumstances, and stay informed about market trends.

Now that you have a solid foundation, start small and gradually increase your investments as you gain confidence and experience. Celebrate even the smallest victories along the way, as each step brings you closer to your financial goals.

Keep in mind that investing is a personal journey, and there’s no one-size-fits-all approach. Take the time to understand your risk tolerance, financial goals, and unique circumstances. With perseverance and the right knowledge, you can unlock the secrets to building wealth and pave the way for a brighter financial future. Happy investing!