Introduction: Investing in the stock market can be a daunting task, especially when there are thousands of companies to choose from. However, for those who have mastered the art of value investing, the possibilities are endless. Value investing involves identifying undervalued stocks that have the potential to provide substantial returns in the long run. In this blog post, we will explore the strategies and techniques used by value investors to uncover those hidden gems in the market.

- Understanding Value Investing: In this section, we will delve into the fundamental principles of value investing. We’ll explain the concept of intrinsic value, margin of safety, and why it’s important to buy stocks at a discount.

- Fundamental Analysis: One of the key tools in value investing is fundamental analysis. We will discuss how to evaluate a company’s financial health, analyze its balance sheet, income statement, and cash flow statement. Additionally, we’ll explore the importance of assessing a company’s competitive advantage and management team.

- Finding Undervalued Stocks: This section will focus on the various techniques used by value investors to identify undervalued stocks. We’ll discuss screening methods, such as price-to-earnings ratio, price-to-book ratio, and dividend yield. Furthermore, we’ll explore the concept of qualitative analysis, including researching industry trends and competitive positioning.

- Patience and Long-Term Investing: Value investing is not a get-rich-quick scheme. It requires patience and a long-term perspective. We’ll emphasize the importance of holding onto investments even during market fluctuations and why short-term volatility should not deter value investors from their strategy.

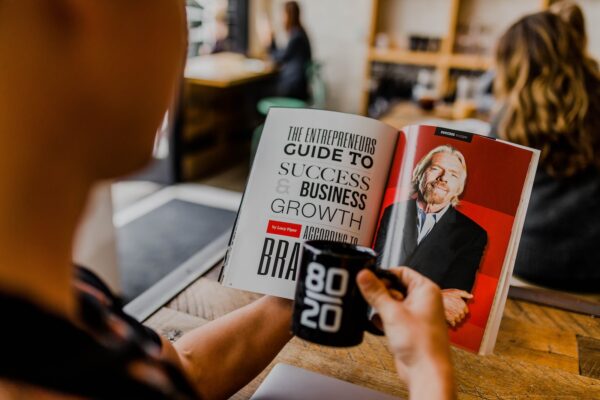

- Case Studies of Successful Value Investors: To provide practical insights, we’ll examine real-life case studies of renowned value investors, such as Warren Buffett, Benjamin Graham, and Charlie Munger. We’ll analyze their investment philosophies and strategies and highlight their most successful investments.

- Risk Management: Value investing comes with risks, and it’s crucial to manage them effectively. We’ll discuss risk mitigation techniques, including diversification, position sizing, and setting exit strategies.

- Tools and Resources for Value Investors: In this section, we’ll explore various tools and resources that can aid value investors in their research and decision-making process. From financial websites and stock screeners to valuation models and investment newsletters, we’ll provide a comprehensive list of valuable resources.

Conclusion: Value investing is a disciplined approach to investing that can lead to substantial long-term returns. By understanding the art of value investing and uncovering undervalued gems in the market, investors can make informed decisions and potentially outperform the market. Remember, it requires patience, diligence, and a commitment to continuously learn and refine your investment strategy.